Behind the Scenes of the European Investment Bank

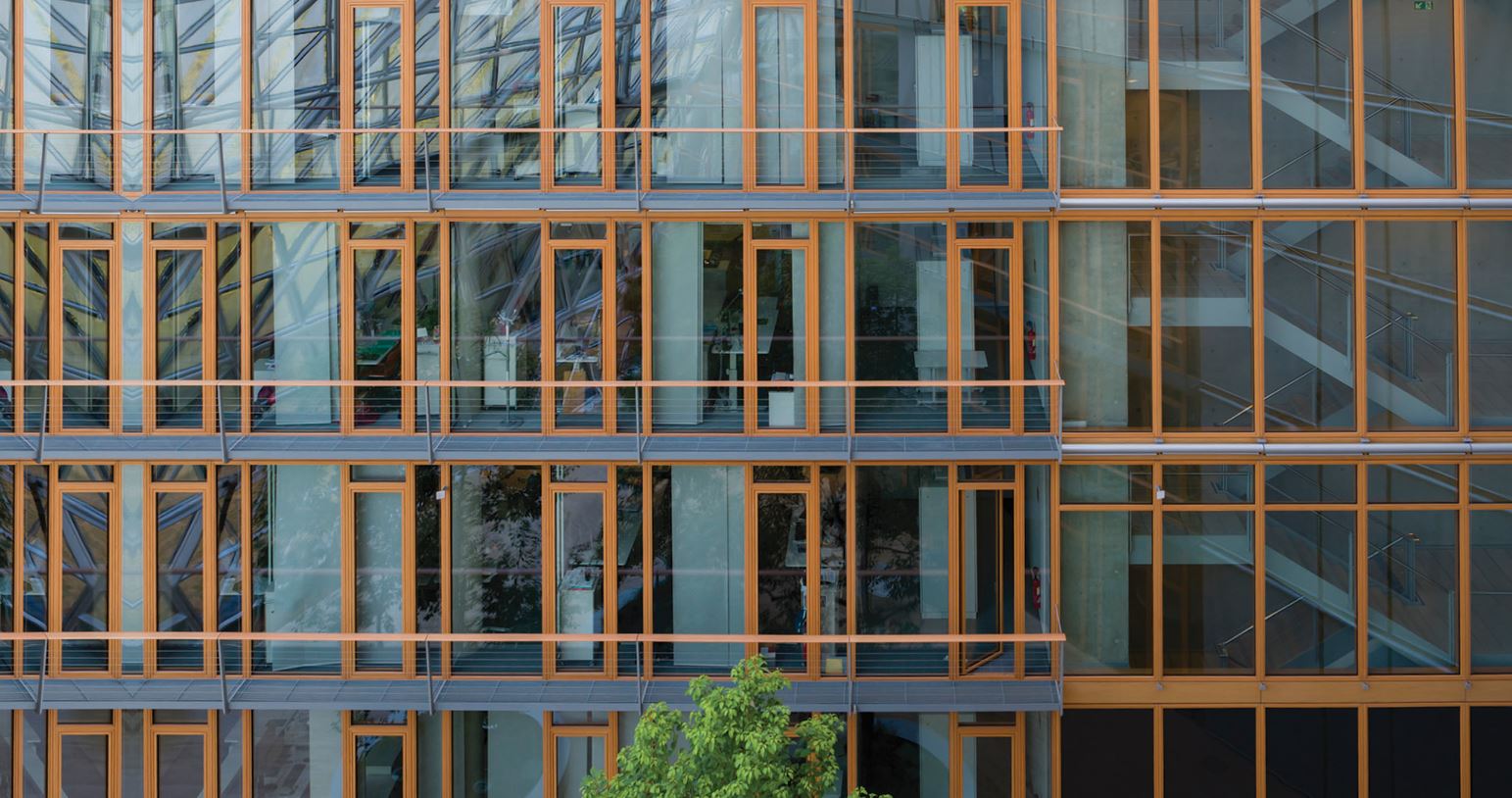

On entering the European Investment Bank (EIB), we are struck by the sense of calm instilled by the high walls allowing light to flow from one part of the building to another. But far from just a great architectural achievement, the essence of the EIB is mainly derived from the people you find there. Those working for the largest bank for investing in the reduction of the global carbon footprint are passionate about sustainable development and the transition to a climate neutral future. For the Grand Format of the magazine, IMS was invited to go behind the scenes at the EIB to meet the experts working tirelessly to build a prosperous Europe.

|

Bruno Rossignol for the EIB Institute |

“Since 2012, the Institute has been the EIB's philanthropic wing. Our team of 15 people work on 3 programmes: art and culture (residencies for young European artists, heritage preservation actions), research and education (research grants, partnership with universities including Luxembourg's), social action (annual tournament of social and solidarity innovation). Each year, we also organize with the University "October days for sustainable development". This year, the debates will focus on SDGs 11 ("Sustainable cities and communities") and 12 ("Responsible production and consumption").

” |

|

|

Shiva Dustdar for the Innovation Finance Advisory Division |

“When you talk about innovation you are dealing with new technologies and new business models. Those things are often untested and it is not clear whether they are bankable or not. The EIB’s advisory services come in to assess the wider innovation landscape and to ask what is the next “big thing”? And how can we support it? In 2014, we looked at how to support the circular economy. In 2016, we conducted a study on the bio-economy and blue economy. Our research led to new support mechanisms for these models. Currently, we are trying to link sustainability with digitalisation as well as space sciences. Luxembourg is a great place to become the "next" digitalised country! It has high-performance computing, a great start-up scene, good legislation and leaders who believe in digitalisation. On the practical side, we are working with about 50 private companies and public entities per year. Up front, we never know whether a project will be eligible for EIB loans or not. If it is not ready for due diligence, we help it through advisory. If the business is ready to be appraised for financing, we prepare it to do it right. Since our advice is not tied to the EIB, our goal is for a company to get financed, including from other banks or funds. Overall, about 25% of our portfolio gets loans from the EIB and 50% from other investors. Our mission is to act as a filter and enabler. ”

|

|

|

Jonas Byström, Liesbet Goovaerts and Christian Schempp for the circular economy |

|

|

|

|

Irene Sánchez Aizpurúa for Climate Action Bonds and the European taxonomy |

“To drive sustainability, projects that contribute to environmental and social objectives need capital. The EIB funds itself on the capital markets, partially through green bonds and sustainability bonds, of which the EIB has issued close to 25 billion euros since 2007. The green bonds focus on climate, whereas the sustainability bonds address social objectives. In both cases, we have a robust system of allocations and impact measurement and indicators. This is important because investors are ever-more demanding in terms of transparency. Thus, to be completely transparent, we also engage with a third party reviewer for audit. This provides an additional assurance to investors, confirming that we are doing what we say we do. Nevertheless, there is still no consensus on what a “green” activity is. The European Commission is very focused on this task. Its technical expert group, which we were part of, has recently published a report on taxonomy, which contains a classification of activities that are considered to contribute to the fight against climate change. The work has been tremendous, but this classification will provide the simplification and transparency that the capital markets need to go from billions to trillions invested into green bonds! This is a real game-changer for the capital markets. ” |

|

|

Gurvand Gaucher for the EMAS Core Team |

“We wanted to make all of the Bank's internal operations as sustainable as possible. To this end, in late 2018 we implemented registration with EMAS, the EU's environmental management instrument and the strictest sustainable development standards certification available. This commitment is encouraging our partners to do the same. The goal, in fact, is to inspire change and show that it can be done! We are very proud to have signed the IMS Zero Single-Use Plastic manifesto, which is a symbol of our commitment to the circular economy and an ongoing framework for how to move forward. There are many passionate people at the Bank, and the EMAS team goal is to raise even more awareness about minimising our environmental impact. “Walk the talk” refers to the idea that we must be exemplary in transport, nutrition and even our cleaning products! As a result, the EIB has already reduced its environmental footprint by 51.8% per employee since 2007 and we don't plan on stopping now! ” |

|

To be read also in the dossier "Small and Bigger Steps Towards a Sustainable Europe":