Why do companies need a nature strategy?

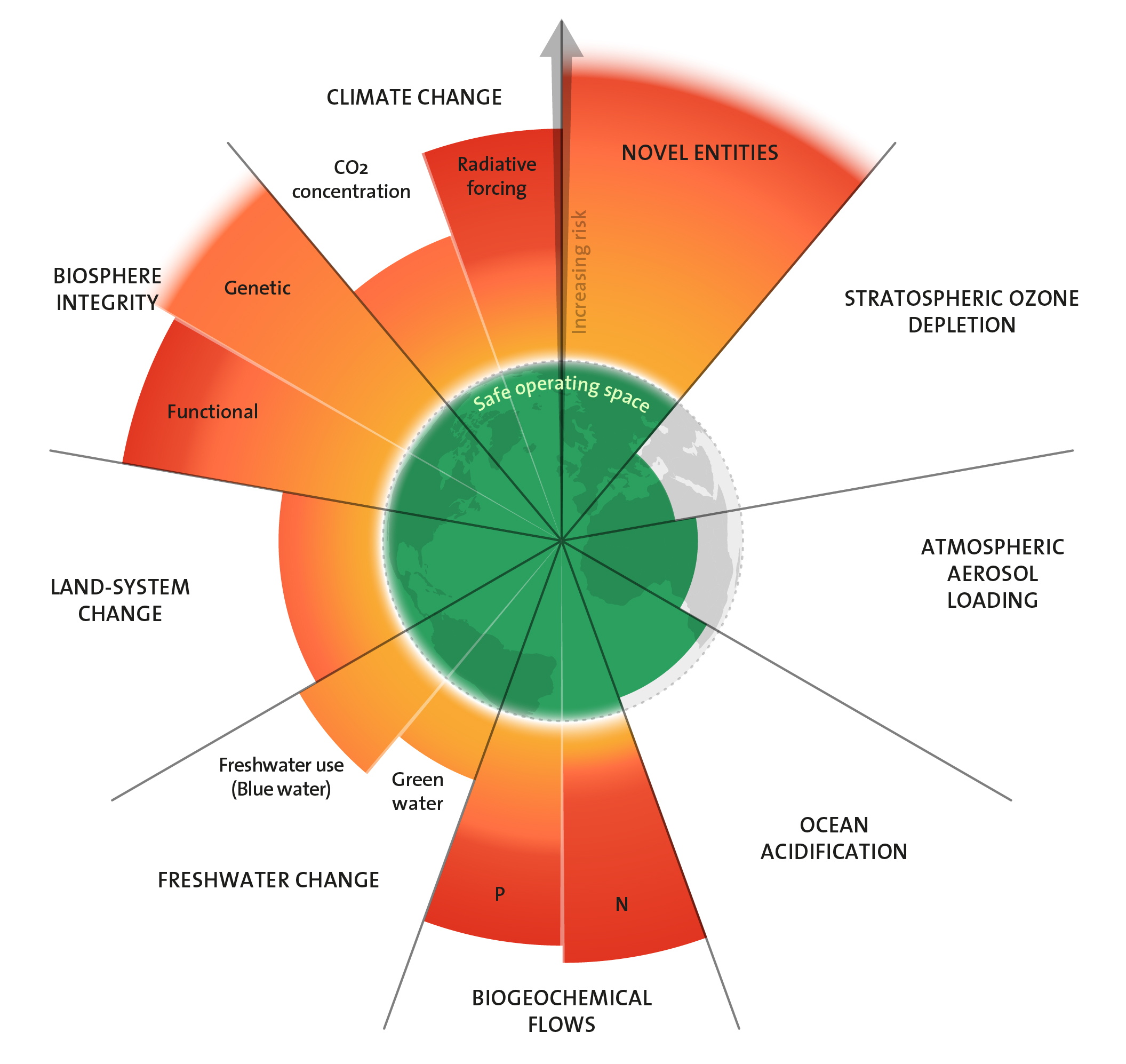

Six of the nine planetary boundaries, as defined by the Stockholm Resilience Centre, have now been breached. These boundaries represent the thresholds of human pressure on nine critical Earth system processes that together ensure the planet’s stability and resilience. Ecosystems are under strain. How do these major disruptions affect the economy ? And why should businesses engage with this issue and adopt a strategy for nature?

The State of Biodiversity: A Challenge for the Economic World

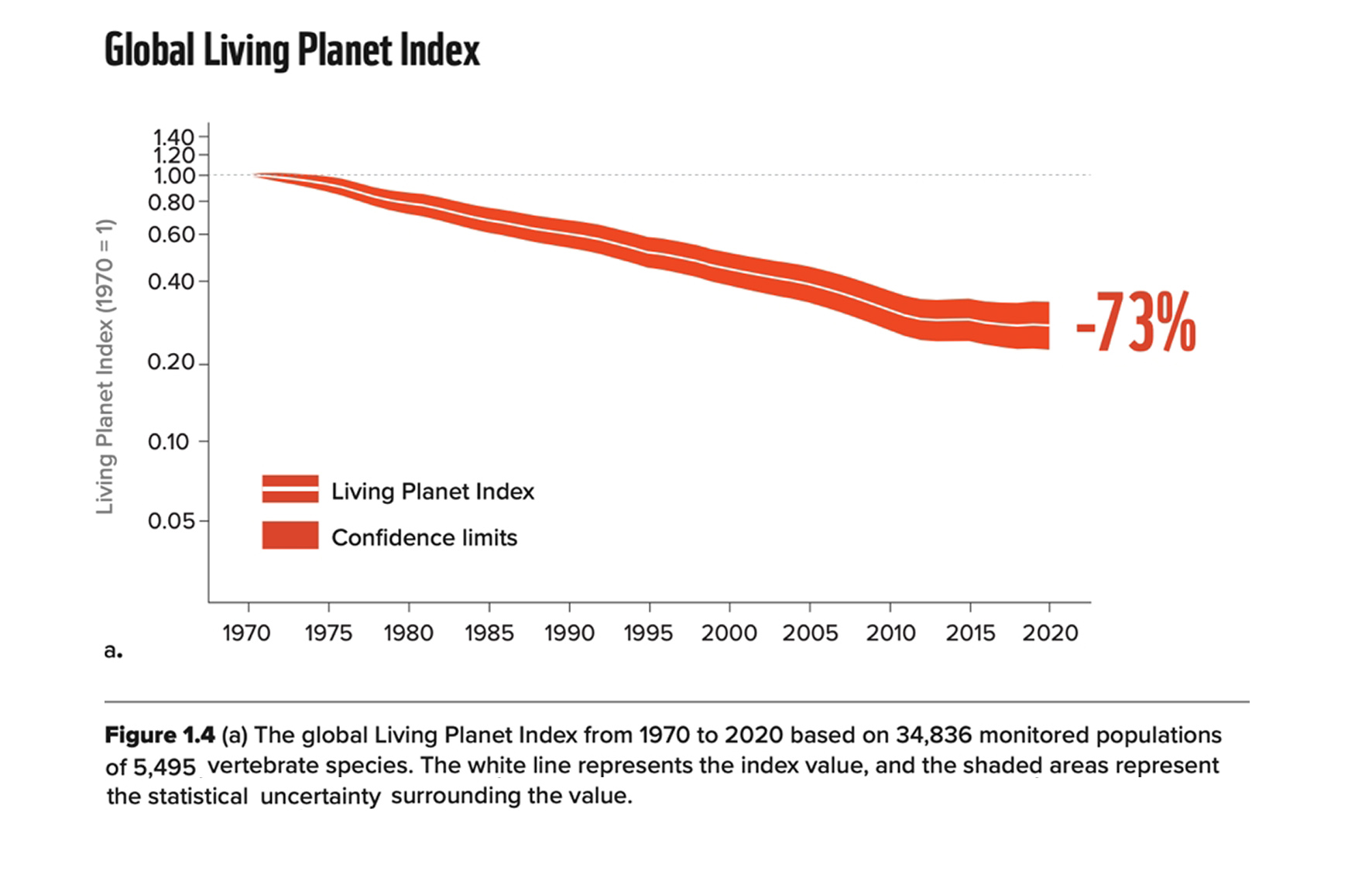

Nature is under threat, that is all life on Earth, along with the inanimate elements of our planet. The Taskforce on Nature-related Financial Disclosures (TNFD) defines nature as an interconnected system of four realms: freshwater, land, ocean, and atmosphere. A fifth element cuts across these realms: society. Humans are inseparable from nature, we live within it, not apart from it. Humans live within this world and are an integral part of what we refer to as "Nature". They are among the vast diversity of living organisms on our planet – in other words, biodiversity. Scientists and international organisations are issuing concrete warnings about what is now described as a new mass extinction event. According to the WWF Living Planet Report 2024, nature is in decline, with dangerous tipping points fast approaching. Over the past 50 years (1970–2020), the average size of wildlife populations has dropped by 73%. How did we end up in such a rapid collapse? Since the 2019 IPBES (Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services) report, which highlighted an unprecedented extinction crisis, it has been established that human activities are the primary cause of biodiversity loss. Five key factors have been identified to explain how this decline is occurring and, more importantly, how humanity can drive the necessary change to halt it: land and ocean use change, the most significant factor; the exploitation of natural resources; climate change; various forms of pollution; and the spread of invasive species. All ecosystems are being affected, with colossal impacts, including on humanity. One example often cited to illustrate these consequences is the degradation of coral reefs, which are essential for the survival of many marine species and lead to a decline in both local and industrial fishing volumes. We are talking here about the loss of ecosystem services, those services provided by nature that humans rely on for the proper functioning of their lives. These services include various resources from nature (food, materials, etc.), climate regulation, water cycle management (such as limiting droughts or floods), the sociocultural benefits of nature, and the various supports necessary for the proper functioning of other systems, such as biogeochemical cycles.

The Planetary Boundaries. Azote for Stockholm Resilience Centre, based on analysis in Richardson et al. 2023. The erosion of biodiversity is reflected in the entire biosphere.

Nature is disappearing. The latest edition of the Living Planet Report, which measures the average change in population sizes of more than 5,000 vertebrate species, shows a decline of 73% between 1970 and 2020.

The IPBES Chairman, Sir Robert Watson, warns: "We are eroding the very foundations of our economies, livelihoods, food security, health, and quality of life worldwide." The 2024 Global Risks report from the World Economic Forum demonstrates that over 55% of global GDP is moderately to highly dependent on nature and the services provided by ecosystems. This amounts to over $58 trillion. Moreover, biodiversity loss and ecosystem collapse were ranked as the second highest risks we will face in the next ten years in the 2025 report. Our global economy is at risk. In light of this, businesses can no longer remain indifferent. Major contributors to ecosystem degradation, they are nonetheless highly dependent on nature. Raw material supply, climate stability, and the well-being and health of employees are just a few examples of ecosystem services crucial to the smooth operation of a business.

During the 15th Conference of the Parties on Biodiversity in December 2022, a historic agreement was reached: the Kunming - Montreal Global Biodiversity Framework. This international framework, signed by 196 governments, aims to halt the degradation of nature by 2030 and outlines 23 targets to preserve ecosystems and ensure a sustainable link between human activities and nature. Businesses play a central role in achieving these objectives. Target 15 specifically identifies the responsibilities of businesses in assessing and reporting their impacts, risks, and dependencies on nature through their direct operations and throughout their value chains. In addition to this international context, national commitments have been made by states to contribute to achieving global targets. In Luxembourg, this is reflected in the National Nature Protection Plan (PNPN), with its third version outlining actions to be implemented by 2030.

Around a quarter of the world's coral reefs have already suffered irreversible damage, and two-thirds are seriously threatened. A precious habitat for many species of fish, their degradation is also leading to a drop in fishing activities.

The food industry is directly dependent on the health of ecosystems. Small ecological farm in Arinos, Brazil.

However, this context is far from sufficient, and too few organisations integrate nature into their strategy. Nevertheless, more businesses are now recognising the multiple risks that nature related impacts pose to their operations. According to a recent report from Business for Nature and the Carbon Disclosure Project (CDP), one in four companies identifies nature-related risks that affect their finances and strategy, amounting to a total exceeding $690 billion.

The major risks faced by businesses that do not undergo transformation are operational, regulatory, and reputational risks.

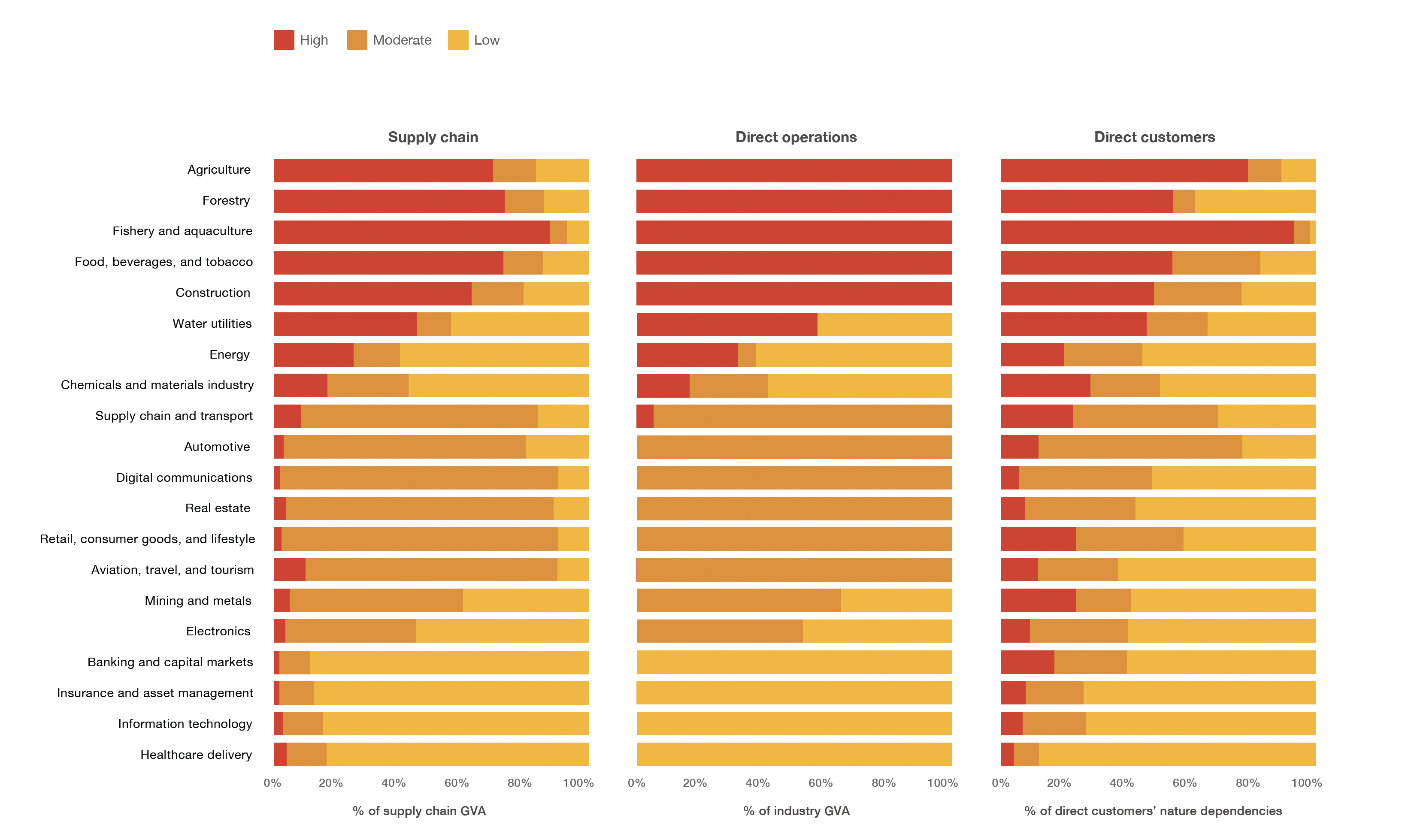

Operational risks for businesses represent a tangible concern in many economic sectors. The three sectors most dependent on nature generate a total value-added of $8 trillion, which is approximately twice the size of the German economy. These sectors—agriculture, construction, and the food industry—are directly dependent on the health of ecosystems for their raw material supply. In addition, they rely on services such as freshwater availability, pollination, and pest and disease control. Therefore, securing supply chains for these businesses is essential.

Other activities can be indirectly affected by these risks. Rabobank highlights in its impact and dependency analysis on nature that 85% of the portion of its analysed portfolio is highly dependent on ecosystem services such as the availability of groundwater and surface water, soil quality, and climate regulation.

Additionally, the tourism industry is often dependent on the health of ecosystems: pollution, desertification, floods... nature sometimes changes its face, and the massive degradation of these ecosystems raises questions about the future of this sector. For the record, tourism activities linked to coral reefs generate an annual value of $36 billion.

Regulatory risks also raise concerns for businesses. Whether to anticipate an increasingly stringent framework or to meet current demanding requirements, all businesses are concerned. Non-compliance with regulations can lead to restrictions on access to land and resources, indemnity costs, and/or delays. Beyond the legal constraint, the obligations to assess and report represent an opportunity for comprehensive risk management, to take action and ensure the company’s resilience.

The special role of financial institutions

Today, financial flows largely fund activities that are harmful to ecosystems. UNEP has highlighted that by redirecting just 7.7% of global financial flows that are currently negative for nature, the necessary funding to fill the investment gap for solutions that protect and restore ecosystems would be achieved. Additionally, according to a study conducted in June 2023 by the European Central Bank, 75% of bank loans in Europe are granted to businesses that are highly dependent on ecosystem services for the production of goods and services.

For more informations : https://www.unepfi.org/industries/banking/nature-target-setting-guidance/

The Corporate Sustainability Reporting Directive (CSRD) is the main obligation currently in force, including the measurement of impacts on terrestrial and marine ecosystems. Despite some uncertainties regarding this regulation, the companies covered by this regulation have mobilized the necessary resources and have thus demonstrated the relevance of these mechanisms for moving the private sector into action.

While the CSRD involves data measurement, other reporting frameworks can highlight all the risks, dependencies, and opportunities of an activity. The Taskforce on Nature-related Financial Disclosures (TNFD) provides a voluntary framework to go further and stand out. By early 2024, 320 companies had reported their intention to use the TNFD framework for analysing and reporting their risks to nature by 2025. By October 2024, this number had risen to more than 500 companies representing a market capitalization of over $6,500 billion.

Finally, reputational risks can serve as a driver of drastic change within private organisations.

Continuing activities harmful to ecosystems can damage a company’s reputation and therefore its viability: this is the message conveyed by various stakeholders, whether through pressure from employees, investors, consumers, or civil society. To demonstrate their commitment to investors, 194 financial institutions signed the Finance for Biodiversity Pledge in 2023, committing to contribute positively to the preservation and restoration of nature. On the contrary, failing to initiate change exposes each company impacting ecosystems to significant risks from stakeholder complaints. The Deepwater Horizon oil spill in the Gulf of Mexico has so far cost BP $65 billion in fines, compensation, and legal fees.

Committing through a nature strategy and a transition plan

Beyond a strictly risk management approach, transitioning to a model that benefits nature also brings multiple opportunities. Companies can generate new revenues and reduce certain costs. New markets and products can emerge from such a transition. For example, Unilever calculated a revenue of 1.2 billion euros over 5 to 7 years through the development of its "plant-based" product offering. According to the World Economic Forum, the potential gains from a transition to nature are estimated at over $10,000 billion by 2030. Cost reduction will come from more efficient resource use. According to a 2022 McKinsey & Company report titled "Nature in Balance", levers such as reducing food waste, regenerative agriculture, and developing models to reduce plastic production could bring annual revenues of 700 billion dollars.

Percentage of direct and supply chain Gross Value Added with high, medium and low nature dependency, by industry The Business Case for Nature

Finally, one of the greatest opportunities is the potential for job creation. The World Economic Forum’s Future of Nature and Business report predicts that a real transition in the energy, construction, and food sectors could create 395 million jobs worldwide. Urgency is raised by numerous international organisations and business leaders around the globe. The World Wildlife Fund (WWF) places this issue at the heart of its current priorities. In a report published in December 2024,it calls on businesses and financial institutions to develop transition plans for nature, with the short-term goal of linking these plans to climate transition plans. A transition plan integrating these two challenges is thus particularly suitable for organisations to identify synergies.

Methodologies to engage

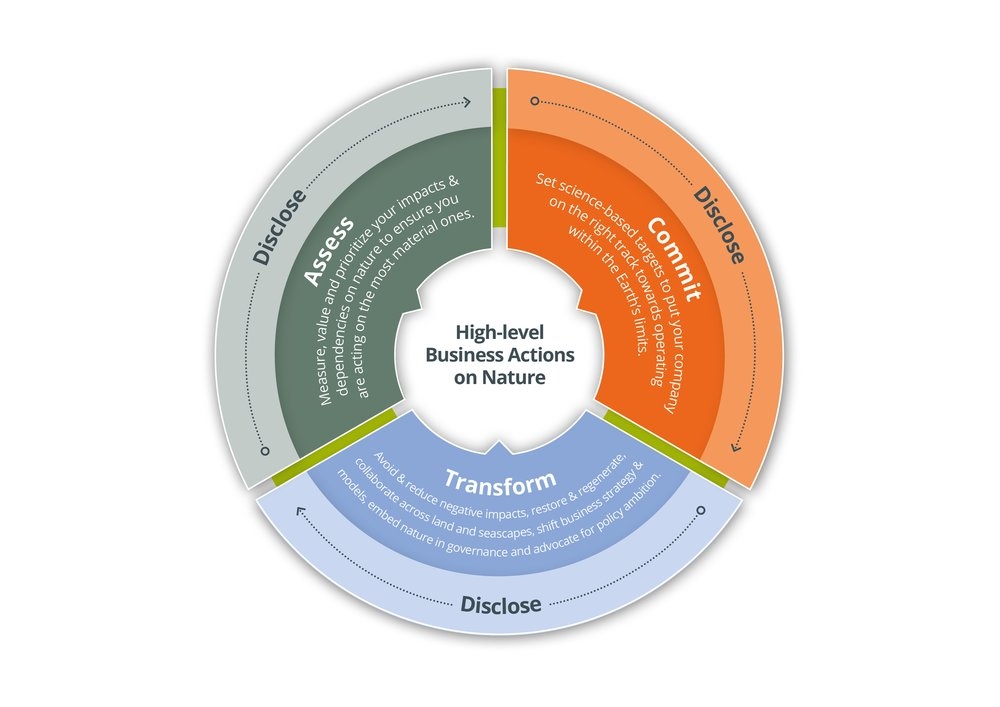

Transforming a business model towards practices and action plans aligned with planetary boundaries is no easy task. To achieve this, methodological frameworks have been developed to help businesses address the urgency. The ACT-D approach, which allows for the development of high-level actions for companies on nature, aligns with the requirements of the Corporate Sustainability Reporting Directive (CSRD), the Science-Based Targets Network (SBTN), and the Taskforce on Nature-related Financial Disclosures (TNFD). This method includes four stages: assessment, engagement, transformation action, and finally, monitoring and reporting.

Assess – Identify risks, impacts, dependencies, and opportunities

First and foremost, it is essential to understand the full extent of the company’s impacts on nature, both at the company sites and through its direct operations, as well as across the upstream and downstream parts of its value chain. A company may exert significant pressure on different components of several ecosystems across various regions of the world. However, these pressures are not all equal. It is the so-called "material" impacts that should form the basis for priority actions. It is crucial to identify the links to biodiversity and gather the necessary data to take action. Several tools can help achieve this. The Global Biodiversity Score, developed by CDP Biodiversity, provides quantitative results reflecting the impacts across a company's entire value chain. The WWF Biodiversity Risk Filter helps prioritise actions. The ENCORE tool, Exploring Natural Capital Opportunities, Risks, and Exposure, is an online platform dedicated to identifying impacts and dependencies by business sectors or for financial institutions.

Once the impacts are identified, the direct and indirect dependencies of a company’s activities on various components of an ecosystem can be mapped, and a materiality analysis can be constructed. For example, through their materiality analysis conducted using the Materiality Screening Tool (MST) from the SBTN, Carrefour confirmed the need for priority efforts on key commodities such as dairy products, meat, and coffee.

Commit – Setting objectives and an action plan

Once the impacts, dependencies, and potentially risks and opportunities are identified and mapped, a company can prioritise actions and set objectives. This is the engagement phase. A company must ensure the coherence of its carbon neutrality objectives with biodiversity preservation, as the climate-biodiversity nexus cannot be addressed in silos. Furthermore, for some companies, specific objectives for the different impacted ecosystems can be defined. The methodology promoted by the SBTN and WWF takes a specific approach for terrestrial ecosystems, freshwater ecosystems, and marine ecosystems.

Independent validation of the objectives set is advisable. This can be done through the Accountability Accelerator, which offers verification based on the latest scientific recommendations.

Patagonia Provisions is expanding into the food sector and focusing on regenerative practices. Here, in partnership with the Good Fish Foundation, selective fishing practices are followed to preserve the oceans.

Transform – Take action

A coherent set of actions is then implemented and monitored to achieve the strategic ambition. It involves two main areas. First, the company’s sites and operations. Green and built spaces present opportunities to reduce impacts and preserve local ecosystems. Measures like delayed mowing practices, installing birdhouses on buildings, and implementing rainwater harvesting systems are just a few possibilities.

The second area concerns the entire value chain. To ensure a real transition, it is necessary to engage stakeholders in the change. Engaging, evaluating, training, and supporting suppliers in identifying impacts and modifying their practices may be appropriate for many companies. Additionally, it is crucial to train and involve employees. They can become potential ambassadors of the topic to a wider audience.

Disclose - Tracking and Reporting

A strategy only becomes a reality when its implementation is closely monitored through proper control mechanisms. In addition, it's crucial to define appropriate governance to ensure the integration of the strategy across the entire organisation. Once the previous steps are underway, it’s also important to disclose the actions taken. Opting to comply with voluntary standards allows the company to showcase its commitment and enhances its image with all stakeholders.

Ensuring the future of our businesses means securing their viability in the world of tomorrow, a world where the services provided by nature can no longer be taken for granted. The collapse of biodiversity presents numerous risks, and it’s time to understand these risks in order to reshape our activities. It is urgent to mobilise efforts to transform our companies and turn them into drivers of a world that benefits both nature and humanity.

To be read also in the dossier "The Business Case for Nature"