Case Study

The CARE method applied by a furniture manufacturer

How to include the CARE/TDL model in my accounting? Imagine the straightforward case of a furniture maker; we will call him OKAI.

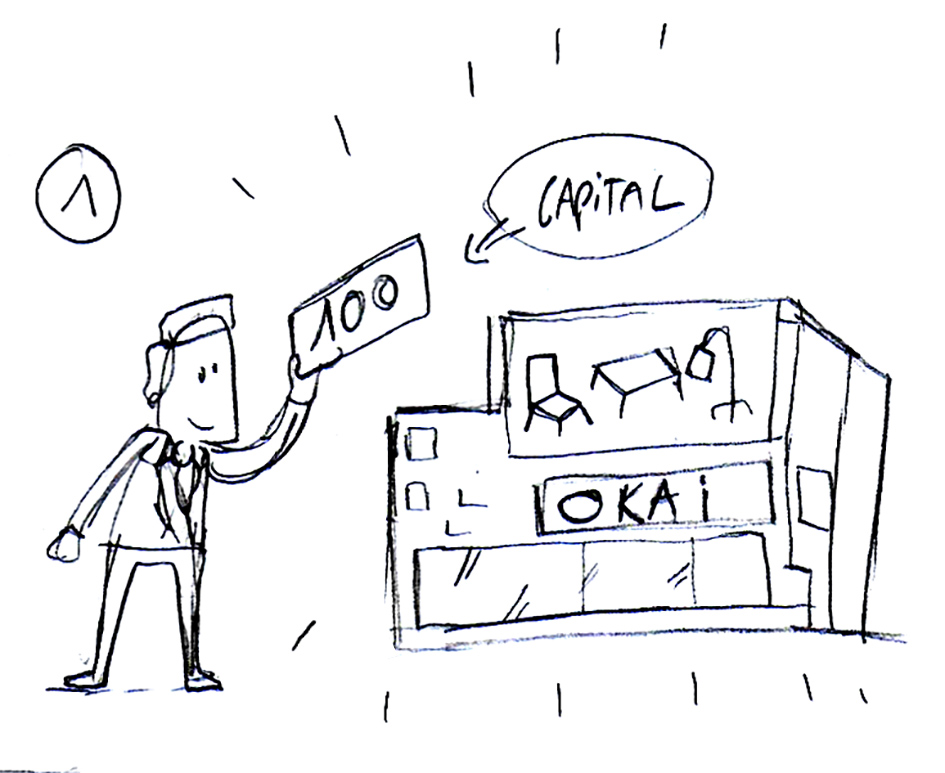

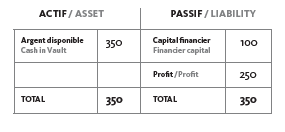

First, let's remember the process in conventional accounting:

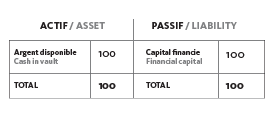

1To start his business, Jonson invests 100. It is the company's capital (a debt to himself) and OKAI's available money. The initial balance sheet is uncomplicated: |

|

|

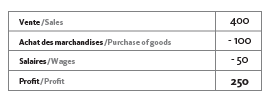

2At the beginning of the first accounting period, OKAI buys wooden boards for 100 and hires an employee paid 50 a period. During this period, the employee transforms the boards into a beautiful piece of furniture. OKAI sells the furniture for 400. The year-end accounts appear as follows:

|

|

|

3The income statement can also be drawn up and shows a profit of 250. |

|

|

At the closing of the period, OKAI has preserved its financial capital and made a profit. Jonson could recover his initial investment as well as a profit. He could also keep profit in his company, either to further develop the firm or to protect his capital from being affected in the event of unforeseen circumstances.

However, no more trace of the employee and even less of the nearby forest exploited to produce the furniture...

Let's rewind!

Let's go back and imagine now that Jonson cares a lot about his business impact on society and the environment around him...

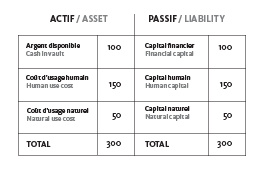

Starting from the postulate that current accounting standards are very efficient in preserving financial capital, the CARE method suggests keeping the majority of existing standards and extending them to natural and social capital. The principles of double-entry accounting (assets/liabilities, debit/credit), income statement, depreciation, etc. therefore continue.

1Jonson asks himself two questions: 1) How much should I pay my employee to allow him a decent life? 2) What is the impact of my activity on the environment? To answer it, he carries out ontological analyses. It appears that: 1) The employee should be paid up to 130 and trained to the amount of 20 to thrive at work and lead a decent life. In total, that makes an amount of 150. 2) OKAI should also spend 50 to preserve the forest from which the wood is sourced. These are the budgets needed over this period to maintain natural and social capitals in their defined state. We also find these amounts in the assets. They are seen as use costs. Here is what it gives in the opening balance sheet: |

|

|

|

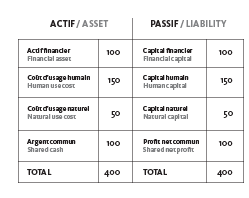

2As in the conventional example, human and natural capitals have deteriorated. It is, therefore, necessary to restore them to prevent negative impact. After selling the furniture and before the end of the period, OKAI will spend 50 on reforestation, 130 in wages, and 20 on training costs. The financial assets are restored by rebuilding stocks. |

|

| At the closing, the capitals and their corresponding assets are thus preserved!

|

|

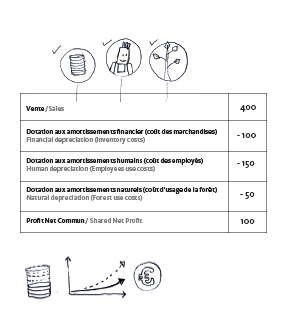

3Along with the balance sheet, the CARE income statement confirms that the final profit has decreased. It is equal to 100. We call it the Common Net Profit because it comes from the 3 capitals and only happens after the 3 capitals are preserved. The triple depreciation line appears, one for each capital. The renewal of each is thus achieved. |

|

In the short term, the strict financial profit is reduced.

This time, OKAI's activity preserves its environment and enables its employee to lead a decent life. In addition, OKAI can highlight its positive approaches, which makes its offer more attractive to consumers.

While the initial impact on financial profit is significant, OKAI improves the way it conducts its business through strategic choices, limiting its environmental and societal footprint. Ultimately, its natural and human use costs will decrease, and its common net profit will increase again. Such an approach also makes it possible to anticipate related costs (taxes, environmental risks, staff turnover or illnesses, and so on).

One step further: OKAI establishes financial, ecological, and social co-management where each capital will be represented equally and independently in decision-making. This is the ultimate proposition of the CARE model.

To be read also in the dossier "The right account" :