Making the invisible visible

Traditional accounting purely and simply only considers the financial data of a company to deduce its wealth and profits. Neither the employees nor nature appears on the balance sheet. This discipline, often considered as a simple tool, is conditioning the way of managing the activity. Far from embracing the complexity of the new issues affecting the private sector, it is no longer unanimous.

The necessary reinvention of accounting

In the same way that the relevance of GDP is questioned at the macroeconomic level, debates intensify around current accounting principles. In the center of discussions: its ability to reflect, through appropriate indicators, the new challenges facing organisations. Some ways of thinking suggest reinventing accounting to consider the three pillars of corporate social responsibility (CSR) on an equal basis: People, Planet and Prosperity. This is what we call sustainable accounting.

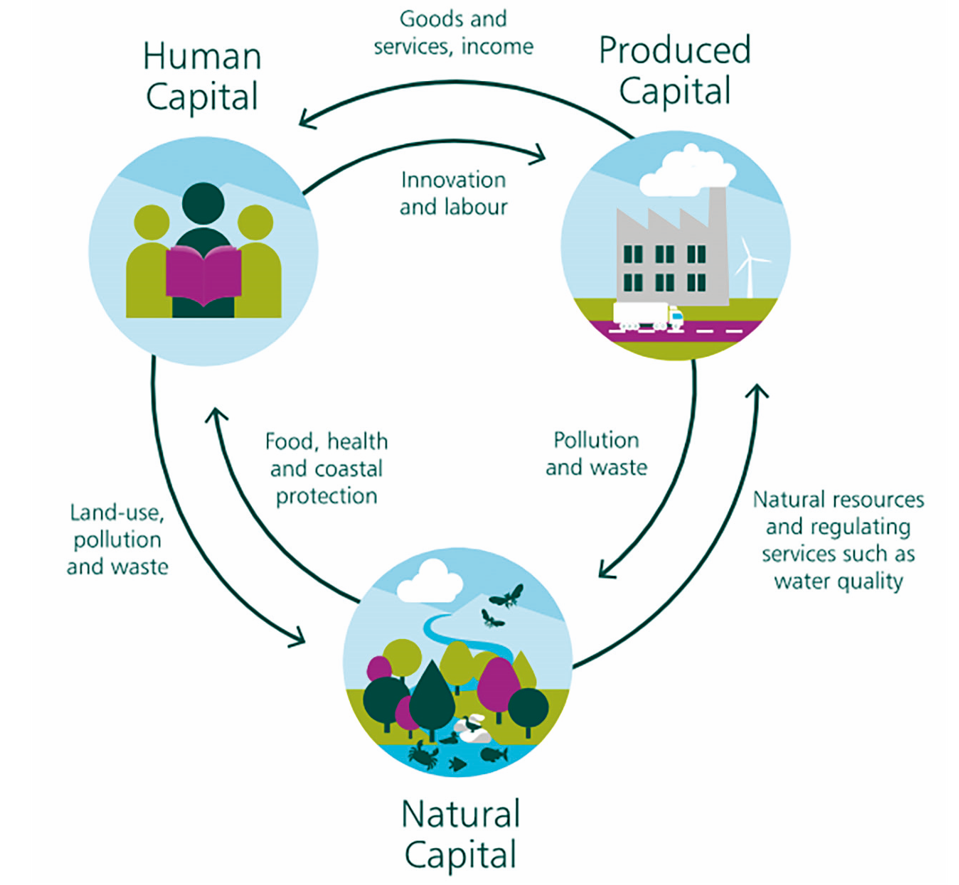

Three types of capital are then identified: still financial capital, but also natural capital and human capital. Taking this into account makes it possible to shed light on the interactions between these three types of capital and reflect on the activity’s dependence and impact.

Measuring above all

The first step is to measure the impacts and therefore deduce the sustainable actions required. As the saying goes, “What gets measured gets done”. Various frameworks or standards exist to help identify the impacts of the activity as closely as possible: Global Reporting Initiative, Natural Capital Protocol, Social & Human Capital Protocol, Greenhouse Gas Protocol Standards, AccountAbility Standards, ISO Standards. The list goes on.

However, these measures are often analysed in silos. The overall impact appears little, and the indicators are different depending on whether we are taking a financial, environmental, or human point of view. This is where sustainable accounting, through its consolidated approach, shows its transformative potential; it becomes a common language, and concerns hitherto reserved for corporate CSR managers are now on the agenda of CFOs. This is the ultimate goal, the completed version of impact measurement.

Interaction between capital

Centralised reading attempts

From employees' well-being to environment preservation, including financial results, the indicators must be found in the same place to be addressed jointly. Different methods exist.

The first one to have been imagined is the Triple Bottom Line. Popularised in the 90s, in the early stages of CSR, it consists of no longer looking only at the financial profit. It established a kind of income statement or balance sheet for the other two axes of sustainable development: People & Planet.

Other approaches followed, notably with the adoption by some companies of Integrated Reporting. This method consists of a joint report on the strategy, governance, and performance on the short, medium, and long terms. This implies taking into account social and environmental aspects in value creation analysis.

Also, let us mention the Environmental Profit & Loss method that the Kering group is experimenting. It involves introducing the negative environmental externalities into the income statement, all along the value chain. The environmental impact of the company is then deducted from its profit. Therefore, it becomes more representative of the reality of the business in its environment.

Take into account what appears

However, these approaches are struggling to entirely convince. If they take environmental and social measures more into account, they do not manage to put these issues on the same level as the financial one. None of these three methods appear on the balance sheet and income statement of companies. Even John Elkington, the author of the Triple Bottom Line method, doubts their effectiveness. In a 2018 Harvard Business Review article with the self-explanatory title: “25 years ago I coined the phrase triple bottom line, here is why I am giving up on it”, he notes the failure of these methods to produce a truly global benchmark on environmental and social issues. According to him, worse still, they would constitute an alibi for inaction and for staying with the Single Bottom Line: the financial profit. Indeed, social and environmental impacts are measured, but they are not at the heart of decisions.

He, therefore, calls for a new generation of methods where measures of social and environmental factors are more integrated and fully apparent in company accounting. The objective would be to genuinely impact the decisions and actions of companies. The social and natural environment would then be on the same level as the financial profit.

A method recently developed and still little known meets this requirement. It is the CARE/TDL approach. It stands for Comprehensive Accounting in Respect of Ecology / Triple Depreciation Line. Would it be the solution to count what really matters and drive change in companies?

Market Prices and Accounting (or Shadow) Prices.

In-depth reform of accounting, the ambition of the CARE method

The approach is revolutionary because it gives as much weight to preserving natural and human capital as to the conservation of financial capital. The father of this method, Jacques Richard, even considers it an ideology because the choice of capital to safeguard is not neutral. Indeed, CARE accounting does claim real transformative potential since the three categories become corporate goals. Such an approach would avoid, according to its designer, social and environmental dumpings, which would appear in the accounting and automatically lose their interest.

Starting from the postulate that current accounting is very successful in preserving financial capital, it is enough, says Jacques Richard, to extend these principles to the two other types of capital in order to preserve them as well. Be careful though, CARE does not call for giving a monetary value to the environment and employees. It is not a commodification of humans or the environment. This capital is not considered there as an asset but as debt capital. It is different from an approach based on negative externalities such as the carbon price, for example. With the principle of strong sustainabilityat its heart, the method prevents compensation between capitals. The amount entered as a liability is the budget necessary to maintain this capital over a given period in line with the definition granted to it. We are talking about maintenance costs.

Concretely, a palm oil business will no longer appear profitable if it contributes to the deforestation of a tropical forest and if its workers operate in inhumane conditions. Conversely, a farm working in harmony with its environment will be more profitable than a sizeable intensive farm, using chemical inputs, destroying its soils, and releasing large quantities of greenhouse gases.

In the end, CARE accounting reveals a common net profit, coming from the three capitals and benefiting them all. Logically, it eliminates the fictitious profits obtained to the detriment of nature and humans.

To ensure that the three capitals are preserved and that the common net profit is used wisely, a triple governance can also be put in place: each of the capitals is then represented independently and equally in the decision-making bodies of the enterprise.

Obstacles to be removed

One quickly understands the brakes that delay adopting such a method; what would be the interest for the palm oil company or the intensive exploitation to establish its accounts based on CARE methodology? Instantly, its profit would be significantly reduced and its negative impact much more noticeable. One would then think that their more virtuous competitors could implement it, but it would also reduce their profit while highlighting remaining progress.

If several initiatives are identified on a small scale, especially in various agroecological farms, no listed company implemented it at the group level yet. Large organisations find it difficult to project themselves into long horizons and unconventional assessments of value creation, as the recent dismissal of Emmanuel Faber by Danone shareholders has shown.

This is in line with the demonstration given in the book “How economists warm the planet”: orthodox economists and investors discount future costs (such as those related to climate change or biodiversity loss) at potentially high discount rates. Therefore, a considerable cost 30 years from now has little importance in the eyes of an investor or a traditional economist.

Hope, however, lies in the transformative potential of methods like CARE. If the company’s profit is reduced in the first year with this new approach, its efforts and progress will appear gradually and could be visible more quickly thanks to this mechanism of discounting future cash flows. As the company adjusts its activity to make it more virtuous, the negative impact on its profit is decreased. The consequences of its activity are thus immediately internalised in its accounts, and it is encouraged to adjust its operations to become more sustainable in the long term.

As with any standardised approach, a critical threshold is key. For a real take-off, a minimum of actors is needed. Several experiences point in this direction. The French PACA region notably launched a pilot group to implement CARE accounting with ten companies of various sizes and sectors. Local branches of Auchan and Pernod Ricard, among others, are part of it. The LVMH group is also conducting experiments in this area on some of its Reims vineyards. Beside, many organisations promote these methods and help put them in place. In France, these include the Chaire comptabilité écologique, the accounting firm Compta Durable, and Fermes d’Avenir, which operates mainly in the agricultural sector. The more CARE accounting is adopted, the more it can be standardised. It has been the same for current accounting which is only a set of defined common rules. Subject matter experts and “green” auditors will then establish sensible rules and ensure their enforcement.

Can sustainable accounting become the new normal? For this method to establish itself as a standard, experts believe that the fastest way would be political decision-making via subsidies, more appropriate taxation, and above all, new accounting laws.The ambition is vast, of course, but it seems to be the right moment to initiate a change. Many companies are already moving in this direction with extra-financial reports and the sustainable finance taxonomy under development within the European Union. While it seems challenging to imagine immediate regulatory measures forcing companies to switch to a rigorous sustainable accounting model, a transitional solution lies in parallel accounting. The revolutionary method could coexist with classical accounting at first so that change can occur. Then, the accounting battle will be engaged!

To be read also in the dossier "The right account" :